OP Mainnet

OP Mainnet

Badges

About

OP Mainnet is an EVM-equivalent Optimistic Rollup. It aims to be fast, simple, and secure.

Badges

About

OP Mainnet is an EVM-equivalent Optimistic Rollup. It aims to be fast, simple, and secure.

Fallback to permissioned proposals for 26 days.

2024 Aug 16th

OP Mainnet preventively disables the fraud proof system due to a bug for 26 days.

OP Mainnet becomes Stage 1

2024 Jun 10th

OP Mainnet introduces fraud proofs and updates permissions.

Funds can be stolen if

MEV can be extracted if

Sequencer failure

Self sequenceState validation

Fraud proofs (INT)Fraud proofs allow actors watching the chain to prove that the state is incorrect. Interactive proofs (INT) require multiple transactions over time to resolve.

Exit window

NoneThere is no exit window for users to exit in case of unwanted regular upgrades as they are initiated by the Security Council with instant upgrade power and without proper notice.

Fraud proofs ensure state correctness

After some period of time, the published state root is assumed to be correct. During the challenge period, anyone is allowed to submit a fraud proof that shows that the state was incorrect.

Funds can be stolen if no validator checks the published state. Fraud proofs assume at least one honest and able validator.

All data required for proofs is published on chain

All the data that is used to construct the system state is published on chain in the form of cheap blobs or calldata. This ensures that it will be available for enough time.

Data batches are compressed using the zlib algorithm with best compression level.

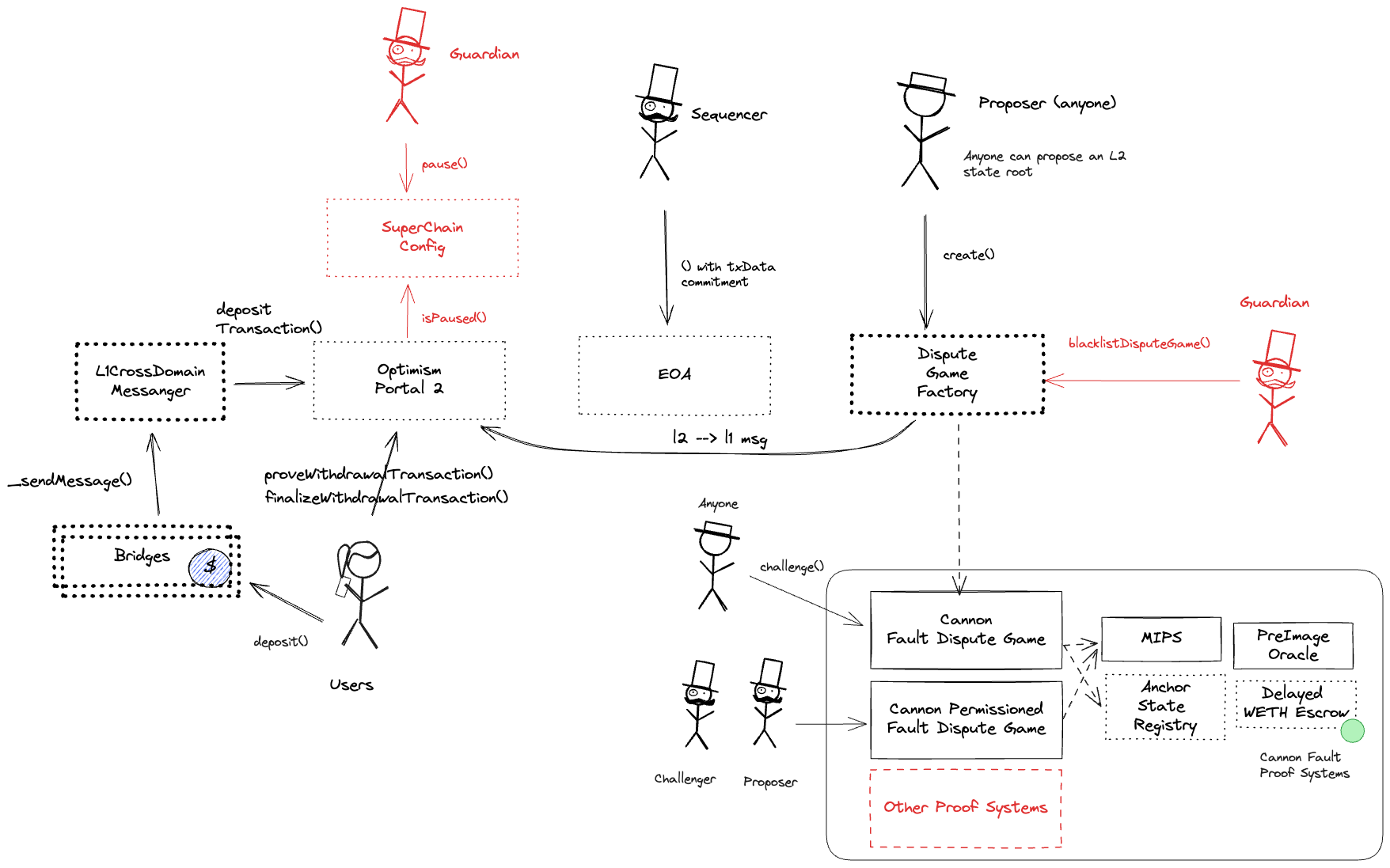

Updates to the system state can be proposed and challenged by anyone who has sufficient funds. If a state root passes the challenge period, it is optimistically considered correct and made actionable for withdrawals.

Proposers submit state roots as children of the latest confirmed state root (called anchor state), by calling the create function in the DisputeGameFactory. A state root can have multiple conflicting children. Each proposal requires a stake, currently set to 0.08 ETH, that can be slashed if the proposal is proven incorrect via a fraud proof. Stakes can be withdrawn only after the proposal has been confirmed. A state root gets confirmed if the challenge period has passed and it is not countered.

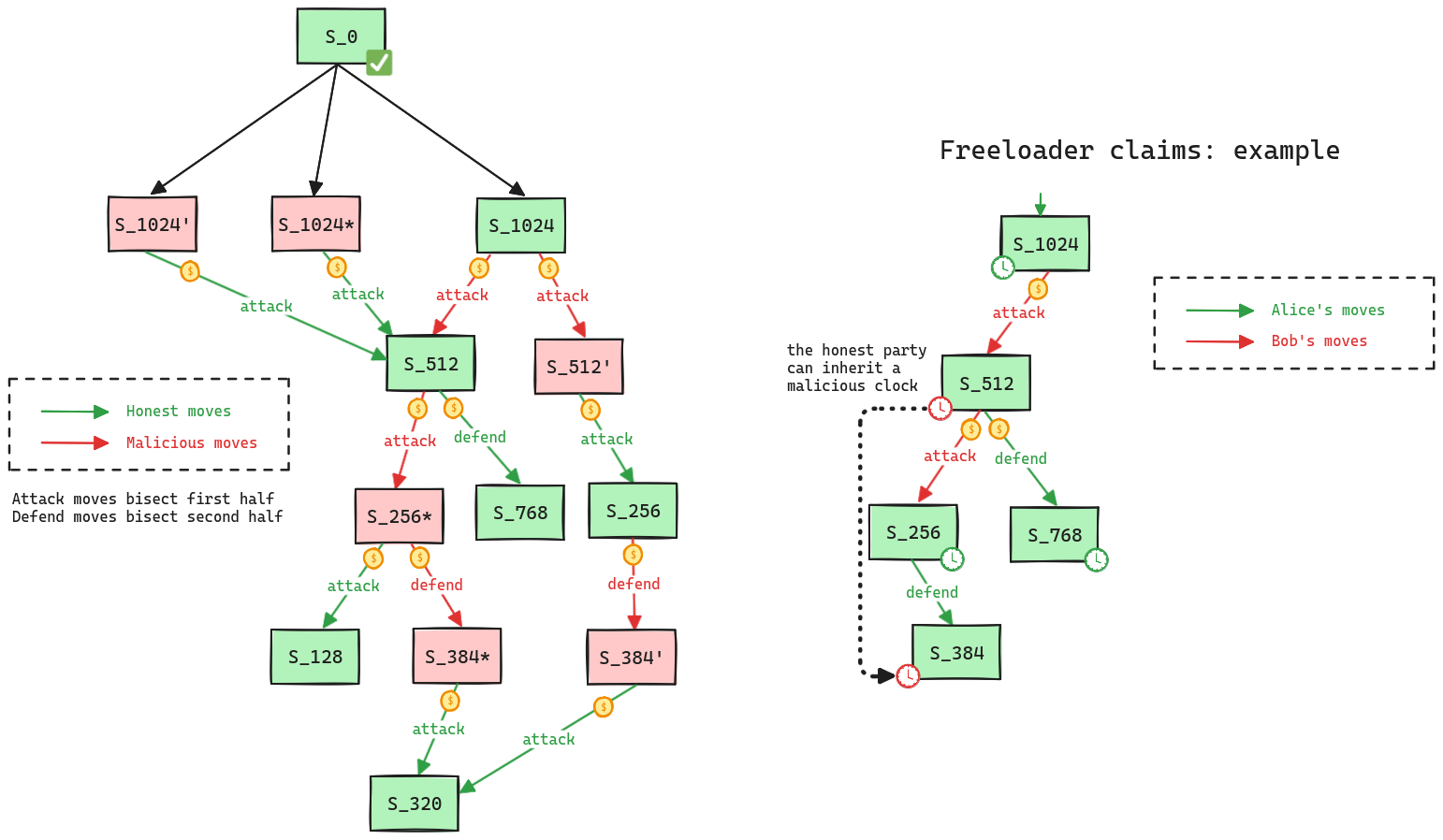

Challenges are opened to disprove invalid state roots using bisection games. Each bisection move requires a stake that increases expontentially with the depth of the bisection, with a factor of 1.09493. The maximum depth is 73, and reaching it therefore requires a cumulative stake of 691.43 ETH from depth 0. Actors can participate in any challenge by calling the defend or attack functions, depending whether they agree or disagree with the latest claim and want to move the bisection game forward. Actors that disagree with the top-level claim are called challengers, and actors that agree are called defenders. Each actor might be involved in multiple (sub-)challenges at the same time, meaning that the protocol operates with full concurrency. Challengers and defenders alternate in the bisection game, and they pass each other a clock that starts with 3d 12h. If a clock expires, the claim is considered defeated if it was countered, or it gets confirmed if uncountered. Since honest parties can inherit clocks from malicious parties that play both as challengers and defenders (see freeloader claims), if a clock gets inherited with less than 3h, it generally gets extended by 3h with the exception of 6h right before depth 30, and 1d right before the last depth. The maximum clock extension that a top level claim can get is therefore 10d. Since unconfirmed state roots are independent of one another, users can decide to exit with a subsequent confirmed state root if the previous one is delayed. Winners get the entire losers’ stake, meaning that sybils can potentially play against each other at no cost. The final instruction found via the bisection game is then executed onchain in the MIPS one step prover contract who determines the winner. The protocol does not enforce valid bisections, meaning that actors can propose correct initial claims and then provide incorrect midpoints. The protocol can be subject to resource exhaustion attacks (Spearbit 5.1.3).

The system has a centralized sequencer

While forcing transaction is open to anyone the system employs a privileged sequencer that has priority for submitting transaction batches and ordering transactions.

MEV can be extracted if the operator exploits their centralized position and frontruns user transactions.

Users can force any transaction

Because the state of the system is based on transactions submitted on the underlying host chain and anyone can submit their transactions there it allows the users to circumvent censorship by interacting with the smart contract on the host chain directly.

Regular exits

The user initiates the withdrawal by submitting a regular transaction on this chain. When a state root containing such transaction is settled, the funds become available for withdrawal on L1 after 3d 12h. Withdrawal inclusion can be proven before state root settlement, but a 7d period has to pass before it becomes actionable. The process of state root settlement takes a challenge period of at least 3d 12h to complete. Finally the user submits an L1 transaction to claim the funds. This transaction requires a merkle proof.

Forced exit

If the user experiences censorship from the operator with regular exit they can submit their withdrawal requests directly on L1. The system is then obliged to service this request or halt all withdrawals, including forced withdrawals from L1 and regular withdrawals initiated on L2. Once the force operation is submitted and if the request is serviced, the operation follows the flow of a regular exit.

EVM compatible smart contracts are supported

OP stack chains are pursuing the EVM Equivalence model. No changes to smart contracts are required regardless of the language they are written in, i.e. anything deployed on L1 can be deployed on L2.

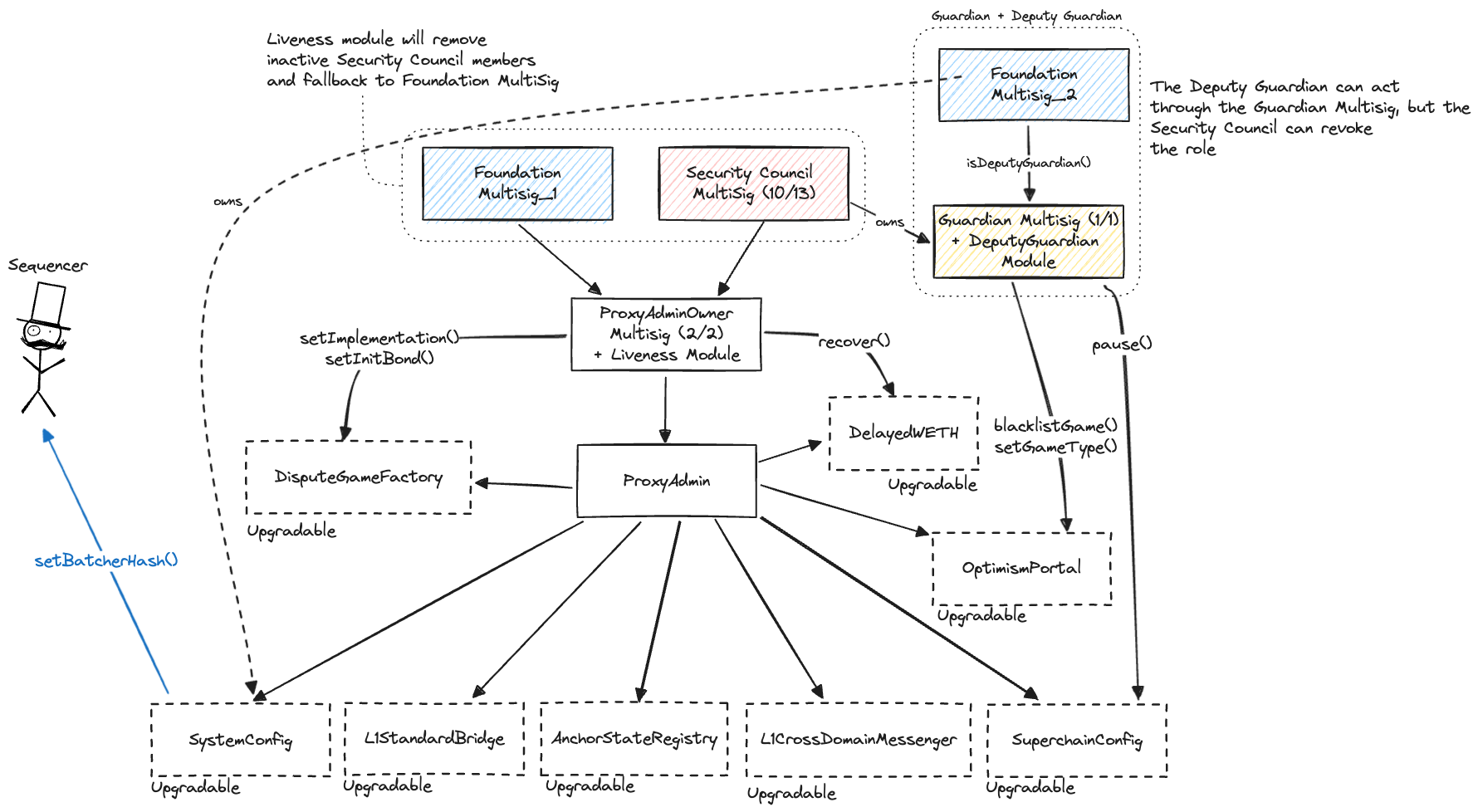

All contracts are upgradable by the SuperchainProxyAdmin which is controlled by a 2/2 multisig composed by the Optimism Foundation and a Security Council. The Guardian role is assigned to the Security Council multisig, with a Safe Module that allows the Foundation to act through it to stop withdrawals in the whole Superchain, blacklist dispute games, or deactivate the fault proof system entirely in case of emergencies. The Security Council can remove the module if the Foundation becomes malicious. The single Sequencer actor can be modified by the OpFoundationOperationsSafe via the SystemConfig contract. The SuperchainProxyAdminOwner can recover dispute bonds in case of bugs that would distribute them incorrectly.

At the moment, for regular upgrades, the DAO signals its intent by voting on upgrade proposals, but has no direct control over the upgrade process.

The system uses the following set of permissioned addresses:

Central actor allowed to submit transaction batches to L1.

Admin of OptimismPortal, L1StandardBridge, L1ERC721Bridge, OptimismMintableERC20Factory, SuperchainConfig, DelayedWETH, DisputeGameFactory, AnchorStateRegistry and SystemConfig contracts.

Used in:

A Gnosis Safe with 2 / 2 threshold. Owner of the SuperchainProxyAdmin. It can upgrade the bridge implementation potentially gaining access to all funds, and change any system component. It also controls the L2ProxyAdmin, meaning it can upgrade L2 system components.

Used in:

A Gnosis Safe with 1 / 1 threshold. It uses the following modules: DeputyGuardianModule (allows the OpFoundationOperationsSafe, called the deputy guardian, to act on behalf of the Gnosis Safe). Address allowed to pause withdrawals or blacklist dispute games in case of an emergency.

Participants (1):

SecurityCouncilMultisigUsed in:

A Gnosis Safe with 5 / 7 threshold. Member of the SuperchainProxyAdminOwner.

Used in:

A Gnosis Safe with 10 / 13 threshold. It uses the following modules: LivenessModule (used to remove members inactive for 98d while making sure that the threshold remains above 75%. If the number of members falls below 8, the OpFoundationUpgradeSafe takes ownership of the multisig). Member of the SuperchainProxyAdminOwner.

Participants (13):

0x07dC…d0730x0a12…58b80x1822…925e0x4A73…e61E0x51aC…3dDa0x5C0F…C47e0x6323…c8650x74FA…B3100x7ed8…9E390x8Afe…0EA40x9Eb1…fD7A0xbfA0…E0d90xE895…E514Used in:

A Gnosis Safe with 5 / 7 threshold. This address is the owner of the following contracts: SystemConfig.

Used in:

The system consists of the following permissions on OP Mainnet:

Admin of L2CrossDomainMessenger, GasPriceOracle, L2StandardBridge, SequencerFeeVault, OptimismMintableERC20Factory, L1BlockNumber, L2ERC721Bridge, L1Block, L1ToL2MessagePasser, OptimismMintableERC721Factory, BaseFeeVault, L1FeeVault, SchemaRegistry and EAS contracts.

A Gnosis Safe with 3 / 5 threshold. Owner of the MintManager. It can change the OP token owner to a different MintManager and therefore change the inflation policy.

The system consists of the following smart contracts on the host chain (Ethereum):

The OptimismPortal contract is the main entry point to deposit funds from L1 to L2. It also allows to prove and finalize withdrawals. It specifies which game type can be used for withdrawals. The current game type is FaultDisputeGame. This contract stores the following tokens: ETH.

Upgrade delay: No delay

Implementation used in:

The L1CrossDomainMessenger (L1xDM) contract sends messages from L1 to L2, and relays messages from L2 onto L1. In the event that a message sent from L1 to L2 is rejected for exceeding the L2 epoch gas limit, it can be resubmitted via this contract’s replay function.

Upgrade delay: No delay

Implementation used in:

Upgrade delay: No delay

Implementation used in:

The dispute game factory allows the creation of dispute games, used to propose state roots and eventually challenge them.

Upgrade delay: No delay

Implementation used in:

Logic of the dispute game. When a state root is proposed, a dispute game contract is deployed. Challengers can use such contracts to challenge the proposed state root.

Same as FaultDisputeGame, but only two permissioned addresses are designated as proposer and challenger.

The MIPS contract is used to execute the final step of the dispute game which objectively determines the winner of the dispute.

Implementation used in:

Contains the latest confirmed state root that can be used as a starting point in a dispute game.

Upgrade delay: No delay

The PreimageOracle contract is used to load the required data from L1 for a dispute game.

Implementation used in:

Contract designed to hold the bonded ETH for each permissionless dispute game. It is designed as a wrapper around WETH to allow an owner to function as a backstop if a game would incorrectly distribute funds. It is owned by the SuperchainProxyAdminOwner multisig.

Upgrade delay: No delay

Implementation used in:

Contract designed to hold the bonded ETH for each permissioned dispute game. It is designed as a wrapper around WETH to allow an owner to function as a backstop if a game would incorrectly distribute funds. It is owned by the SuperchainProxyAdminOwner multisig.

Upgrade delay: No delay

Implementation used in:

The SuperchainConfig contract is used to manage global configuration values for multiple OP Chains within a single Superchain network. The SuperchainConfig contract manages the PAUSED_SLOT, a boolean value indicating whether the Superchain is paused, and GUARDIAN_SLOT, the address of the guardian which can pause and unpause the system.

Upgrade delay: No delay

Proxy used in:

The DeputyGuardianModule is a Gnosis Safe module that allows the OP Foundation to act through the GuardianMultisig, which is owned by the Security Council. It is used to pause withdrawals in case of an emergency, blacklist games, disable the proof system, and update the anchor state. The Security Council can disable the module if the Foundation acts maliciously.

Upgrade delay: No delay

The LivenessModule is a Gnosis Safe nodule used to remove Security Council members that have been inactive for 98d while making sure that the threshold remains above 75%. If the number of members falls below 8, the OpFoundationUpgradeSafe takes ownership of the multisig.

Upgrade delay: No delay

Implementation used in:

The system consists of the following smart contracts on OP Mainnet:

The OP token contract. It is owned by the MintManager and can inflate the token supply by 2% annually.

Controls the OP inflation rate, which is currently hardcoded to 2% annually. It is controlled by the MintManagerOwner multisig, which can also change the OP token owner and therefore the inflation rate.

The L2CrossDomainMessenger (L2xDM) contract sends messages from L2 to L1, and relays messages from L1 onto L2 with a system tx. In the event that a message sent from L2 to L1 is rejected for exceeding the L1 gas limit, it can be resubmitted via this contract’s replay function.

Upgrade delay: No delay

Upgrade delay: No delay

Contract used internally by the L2CrossDomainMessenger to send messages to L1, including withdrawals. It can also be used directly as a low-level interface.

Upgrade delay: No delay

Contract collecting base fees, which are withdrawable to the FeesCollector on L1.

Upgrade delay: No delay

Upgrade delay: No delay

Upgrade delay: No delay

Contracts to register schemas for the Ethereum Attestation Service (EAS).

Upgrade delay: No delay

Contract containing the main logic for the Ethereum Attestation Service (EAS).

Upgrade delay: No delay

Value Secured is calculated based on these smart contracts and tokens:

Implementation used in:

Implementation used in:

DAI Vault for custom DAI Gateway managed by MakerDAO.

SNX Vault for custom SNX Gateway managed by Synthetix.

wstETH Vault for custom wstETH Gateway. Fully controlled by Lido governance.

The current deployment carries some associated risks:

Funds can be stolen if a contract receives a malicious code upgrade. Both regular and emergency upgrades must be approved by both the Security Council and the Foundation. There is no delay on regular upgrades.